object(WP_Post)#3544 (24) {

["ID"]=>

int(6155)

["post_author"]=>

string(1) "7"

["post_date"]=>

string(19) "2022-05-27 12:06:48"

["post_date_gmt"]=>

string(19) "2022-05-27 12:06:48"

["post_content"]=>

string(9951) "

What is crowdlending?

Crowdlending, also known as a subordinated loan or mezzanine loan, allows promoters, real estate companies, or landowners to finance their real estate projects.

This type of loan meets the various needs of the real estate promoter, the real estate company, or the landowner:

- This will be used for the acquisition of land, but also for the construction and commercialization of a property.

- But also the existing assets concerning the renovation or refinancing of already existing properties.

- Investment properties.

- Commercial buildings.

How does crowdlending work?

The Swiss Bankers' Association stipulates that as part of the financing of an investment property, the borrower must provide at least 25% of the value of the property as equity. As for the debt, it must be amortized within a maximum of 10 years at two-thirds of its value.

However, a good part of your cash flow will be blocked on this transaction. This is the reason why some financial institutions, financial companies, or banking establishments have specialized in crowdlending.

Crowdlending allows you to increase the capital borrowed up to 80% - 85% (in some cases up to 90% when buying and selling a property in parallel) of the value of the loan on an investment property, which allows the borrower to obtain additional equity since he will have to bring only 10% - 20% instead of 25%.

Thus, the loan applicant's financial flexibility is increased and will allow him to further develop his real estate portfolio. In some cases, when the borrower has additional collateral (securities, insurance policies, land, personal assets) the loan rate can rise to 90% or even 100%.

The crowdlending allows you to solve certain problems

Currently, if a person wants to borrow for a real estate project, he will face a number of problems:

- Banks have strict requirements for maintaining equity.

- Promoters, landowners, and real estate companies may miss out on new opportunities because their capital is locked up in existing/ongoing projects.

- Promoters, landowners, and real estate companies seek additional equity through partners/associates/club deals, which reduces their returns as they share their financial margin.

Figure 1: Capital structure for a real estate project with an equity loan

Crowdlending allows promoters, real estate companies, or landowners to finance a cash deficit by interested investors. The investor does not become a co-owner but only a lender. In return, he will receive interest and a mortgage pledge.

The process of crowdlending

Two points are important during the financial arrangement or the structuring of the file:

- The payment of interest takes place every 6 / 12 months

- The repayment of the capital is done at the end of the term (12 to 36 months)

The financial companies offering crowdlending use their platform to inform their investors of a potential project to proceed to the fundraising. The fundraising will take place once the financial company has analyzed the real estate promoter/real estate company/landowners, its project, and its financial situation.

The promoter/real estate company/landowners then plan, manage, and commercialize the real estate operation.

Once the project is completed, the promoter/real estate company/landowners receive the profit from the sale, and then the loan is repaid and the interest is paid to the investors.

It should be noted that the financial company offering crowdlending does not replace the bank but complements the equity.

Thus, the promoter/ real estate company/landowners benefit from a leverage effect that allows him to reduce the amount of his investment.

An organization between different actors

- The duration of the loan varies between 12 and 36 months.

- The repayment of the debt takes place at the end of the fixed term in one installment. That is, there is no amortization during the defined period.

There are 4 steps in the operation:

- Investors finance the real estate project through the platform.

- The promoter plans, pilots and commercializes the real estate operation.

- The profit from the sale is received by the promoter.

- The loan is repaid and the interests are paid to the investors

The process is very fast:

- First contact with the company.

- Analysis of the operation in 7 days.

- Set up of contracts between 5 and 10 days.

- Fundraising between 5 and 30 days.

- Follow-up and reporting throughout the project.

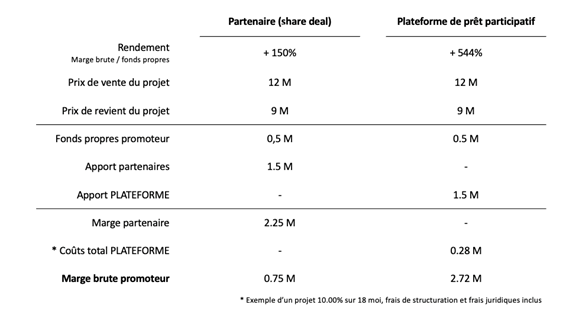

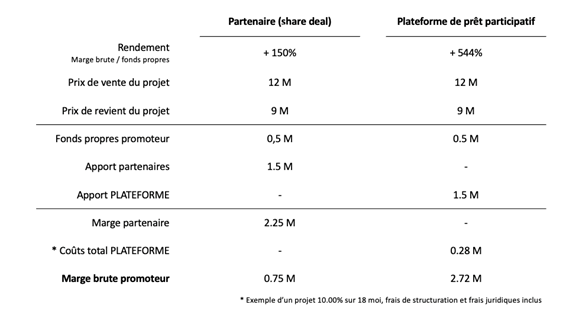

By using a crowdlending platform, the promoter takes three times more gross margin than if he had invited a partner on the project.

* Structuring costs are business expenses that do not vary with business volume.

** The legal costs included are those related to the procedure (expert fees, etc.) and also other costs (travel expenses, etc.).

What happens if the company that took out the loan does not pay it back?

When analyzing the file, the financial company offering the crowdlending always takes into account an "exit" strategy. In other words, it takes into account a full repayment of the debt in case of non-repayment of the loan by the promoter.

Selection criteria

To benefit from a crowdlending between CHF 1 million to 10 million, you must :

- Have a project on the Swiss territory.

- Want to finance all types of real estate projects

- Make a repayment between 12 and 36 months.

- Be a real estate professional.

Things to remember about the equity loan

- Liquidity

Crowdlending helps to overcome the lack of equity so that new investment opportunities are not missed due to a lack of liquidity.

- Control

With the crowdlending, the promoter, real estate company, or landowners remains the unique owner of the project and has the power to make decisions.

- Leverage

The return on equity is more attractive with the crowdlending. Thus, it allows you to keep the entire margin because the use of partners/associates/club deals is not necessary.

PrestaFlex helps you finance your project

For each type of situation, our teams have the solution. With several real estate projects, we have the knowledge and skills to help you. Our SME financing consultants work with partners in the real estate industry and can help you with your ideas and desires.

If you would like to know more, contact us on our website and fill in our form. We assure you a reliable, fast, and discreet service. Since 2013, we have been dealing with entire Switzerland in 4 languages. At PrestaFlex, we have no barriers and all projects receive special attention.

What is crowdlending?

Crowdlending, also known as a subordinated loan or mezzanine loan, allows promoters, real estate companies, or landowners to finance their real estate projects.

This type of loan meets the various needs of the real estate promoter, the real estate company, or the landowner:

- This will be used for the acquisition of land, but also for the construction and commercialization of a property.

- But also the existing assets concerning the renovation or refinancing of already existing properties.

- Investment properties.

- Commercial buildings.

How does crowdlending work?

The Swiss Bankers’ Association stipulates that as part of the financing of an investment property, the borrower must provide at least 25% of the value of the property as equity. As for the debt, it must be amortized within a maximum of 10 years at two-thirds of its value.

However, a good part of your cash flow will be blocked on this transaction. This is the reason why some financial institutions, financial companies, or banking establishments have specialized in crowdlending.

Crowdlending allows you to increase the capital borrowed up to 80% – 85% (in some cases up to 90% when buying and selling a property in parallel) of the value of the loan on an investment property, which allows the borrower to obtain additional equity since he will have to bring only 10% – 20% instead of 25%.

Thus, the loan applicant’s financial flexibility is increased and will allow him to further develop his real estate portfolio. In some cases, when the borrower has additional collateral (securities, insurance policies, land, personal assets) the loan rate can rise to 90% or even 100%.

The crowdlending allows you to solve certain problems

Currently, if a person wants to borrow for a real estate project, he will face a number of problems:

- Banks have strict requirements for maintaining equity.

- Promoters, landowners, and real estate companies may miss out on new opportunities because their capital is locked up in existing/ongoing projects.

- Promoters, landowners, and real estate companies seek additional equity through partners/associates/club deals, which reduces their returns as they share their financial margin.

Figure 1: Capital structure for a real estate project with an equity loan

Crowdlending allows promoters, real estate companies, or landowners to finance a cash deficit by interested investors. The investor does not become a co-owner but only a lender. In return, he will receive interest and a mortgage pledge.

The process of crowdlending

Two points are important during the financial arrangement or the structuring of the file:

- The payment of interest takes place every 6 / 12 months

- The repayment of the capital is done at the end of the term (12 to 36 months)

The financial companies offering crowdlending use their platform to inform their investors of a potential project to proceed to the fundraising. The fundraising will take place once the financial company has analyzed the real estate promoter/real estate company/landowners, its project, and its financial situation.

The promoter/real estate company/landowners then plan, manage, and commercialize the real estate operation.

Once the project is completed, the promoter/real estate company/landowners receive the profit from the sale, and then the loan is repaid and the interest is paid to the investors.

It should be noted that the financial company offering crowdlending does not replace the bank but complements the equity.

Thus, the promoter/ real estate company/landowners benefit from a leverage effect that allows him to reduce the amount of his investment.

An organization between different actors

- The duration of the loan varies between 12 and 36 months.

- The repayment of the debt takes place at the end of the fixed term in one installment. That is, there is no amortization during the defined period.

There are 4 steps in the operation:

- Investors finance the real estate project through the platform.

- The promoter plans, pilots and commercializes the real estate operation.

- The profit from the sale is received by the promoter.

- The loan is repaid and the interests are paid to the investors

The process is very fast:

- First contact with the company.

- Analysis of the operation in 7 days.

- Set up of contracts between 5 and 10 days.

- Fundraising between 5 and 30 days.

- Follow-up and reporting throughout the project.

By using a crowdlending platform, the promoter takes three times more gross margin than if he had invited a partner on the project.

* Structuring costs are business expenses that do not vary with business volume.

** The legal costs included are those related to the procedure (expert fees, etc.) and also other costs (travel expenses, etc.).

What happens if the company that took out the loan does not pay it back?

When analyzing the file, the financial company offering the crowdlending always takes into account an “exit” strategy. In other words, it takes into account a full repayment of the debt in case of non-repayment of the loan by the promoter.

Selection criteria

To benefit from a crowdlending between CHF 1 million to 10 million, you must :

- Have a project on the Swiss territory.

- Want to finance all types of real estate projects

- Make a repayment between 12 and 36 months.

- Be a real estate professional.

Things to remember about the equity loan

- Liquidity

Crowdlending helps to overcome the lack of equity so that new investment opportunities are not missed due to a lack of liquidity.

- Control

With the crowdlending, the promoter, real estate company, or landowners remains the unique owner of the project and has the power to make decisions.

- Leverage

The return on equity is more attractive with the crowdlending. Thus, it allows you to keep the entire margin because the use of partners/associates/club deals is not necessary.

PrestaFlex helps you finance your project

For each type of situation, our teams have the solution. With several real estate projects, we have the knowledge and skills to help you. Our SME financing consultants work with partners in the real estate industry and can help you with your ideas and desires.

If you would like to know more, contact us on our website and fill in our form. We assure you a reliable, fast, and discreet service. Since 2013, we have been dealing with entire Switzerland in 4 languages. At PrestaFlex, we have no barriers and all projects receive special attention.

The subordinated loan

The subordinated loan  An excellent deal was concluded by our financing consultant Gabriel Oberson

An excellent deal was concluded by our financing consultant Gabriel Oberson